In recent years, people from all around the globe have embraced the convenience and joy of online shopping. With the rise of online shopping also rose E-wallets.

Whether or not you are already using an e-wallet it’s a good idea that you learn as much as you can about it. After all, it’s not impossible that a few years from now, it’s all we use for all our transactions.

So going back, what exactly are in-app wallets and what does it have to do with the customer lifetime value?

What Are E-Wallets?

E-wallets, also known as digital wallets or mobile wallets, allow you to store credit cards, debit cards, credits, and sometimes loyalty cards on your smartphone, instead of traditionally in a physical wallet.

By doing so, when you are out and about shopping, you just have to bring your smartphone to pay for your purchases.

Gone are the days you have to lug your wallet or purse around.

You can use the e-wallets for digital payments when you do your online shopping as well.

Some e-wallets allow you to send, receive and store money too.

Good, or good?

In-App Wallets Dominating South East Asia

1. GrabPay

As you can probably guess, the company behind GrabPay is Grab – one of Southeast Asia’s top mobile technology companies.

- It offers easy payment for Grab ride and Grab express deliveries, and load purchases.

- There are many cash-in and cash-out options to choose from.

Countries Available: Singapore, Malaysia, Cambodia, Indonesia, Myanmar, Philippines, Thailand, Vietnam and Japan

2. ShopeePay

ShopeePay is Shopee’s official in-app e-wallet. This allows users to quickly and conveniently top-up, purchase, and withdraw through ShopeePay.

Countries Available: Philippines, Taiwan, Thailand, Singapore, Malaysia, Indonesia and Vietnam.

3. Lazada E-Wallet

Lazada, one of the most popular online shopping websites in the Philippines, is an ever-evolving e-commerce platform. Breaking into the scene as an online store for third-party sellers, it has expanded with the launch of LazMall. And with its introduction of the mobile wallet, they’ve made payment transactions even easier and faster.

Countries Available: Indonesia, Malaysia, the Philippines, Singapore, Thailand and Vietnam

4. Alipay

Alipay is China’s most widely used third-party online payment app.

Its primary product is the digital wallet, Alipay Wallet, which allows customers to conduct transactions directly from their mobile devices.

Countries Available: More than 110 countries and regions around the world, including the United States, Brazil, Russia, Ukraine, Belarus, Germany, the Netherlands, Spain, Israel, Turkey, Italy, and more.

5. EZ-Link Wallet

The EZ-Link card was the very first contactless stored value card introduced in Singapore for public transport use.

Now with the EZ-Link Wallet, which resides within the EZ-Link app, users can make payments at retail outlets in Singapore by scanning an SG QR code or in Japan at an Alipay Connect-enabled merchant.

You can also earn EZ-Link rewards points for your digital wallet transactions.

Countries Available: Singapore

6. FavePay

FavePay is a cashless mobile payment feature on the Fave app. It doesn’t store any money in-app, unlike its peers.

Users can receive cashback or discounts when you use FavePay to pay selected merchants with the FavePay QR code.

You can link up your Fave app to pay for merchants using your credit or debit card, or GrabPay.

With GrabPay, you can earn up to four GrabRewards points for every dollar spent.

Countries Available: Singapore and Malaysia

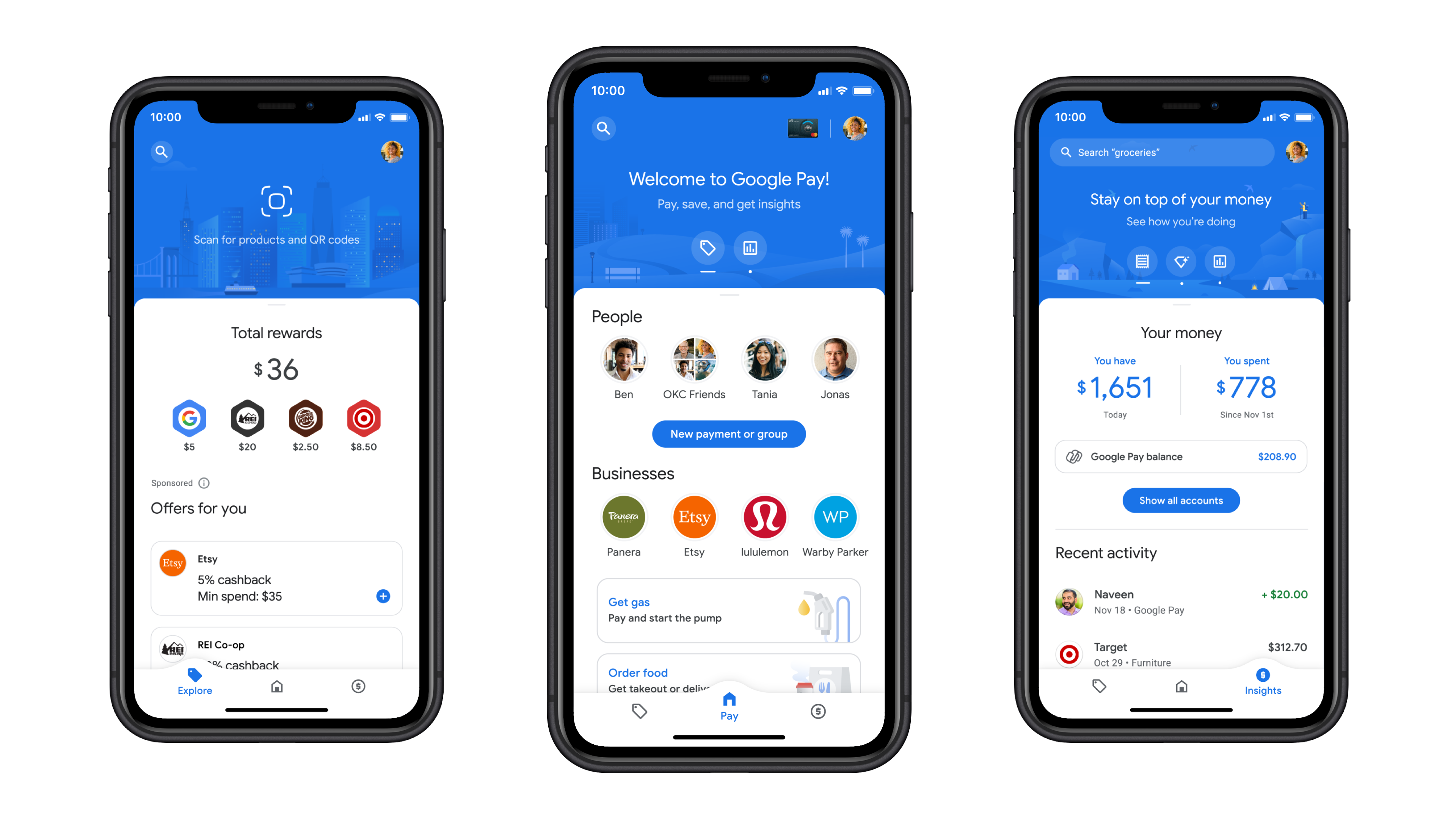

7. Google Pay

Google Pay is a non-banking payment app which allows you to:

- send money to anyone via PayNow for DBS PayLah!, OCBC

- Bank, and Standard Chartered users scan and make payment via the PayNow QR code

- pay for your bus or MRT rides by tapping your Android phone at the gantry

- tap and pay for your purchases in-stores at more than 80,000 checkout counters.

Countries Available: You can use Google Pay to send money in the US and India. You can use this Google Pay feature in Australia, Canada, India, Japan, Russia, Singapore, Ukraine, the United Kingdom, and the United States.

8. Singtel Dash

Singtel Dash prides itself in being Singapore’s first all-in-one mobile payments solution.

It allows you to make online and in-store purchases, both locally and globally, pay using the app for public transport in Singapore, send money to countries such as China, India, Indonesia and Malaysia.

Singtel Dash also allows you to send money to your friends locally.

Countries available: Singapore, China, Indonesia and Malaysia.

9. WeChat Pay

Just like Alipay, WeChat Pay is also one of the top players in China’s mobile payment industry.

If you wish to open a WeChat Pay account, you need a Chinese bank account and a Chinese bank card.

In Singapore, WeChat Pay can be used onboard ComfortDelGro taxis, and at 7-Eleven, Cold Storage, Giant, Guardian, and so on.

Countries available: You can use WeChat Pay if you are in Mainland China, Hong Kong Special Administrative Region, South Africa and Malaysia.

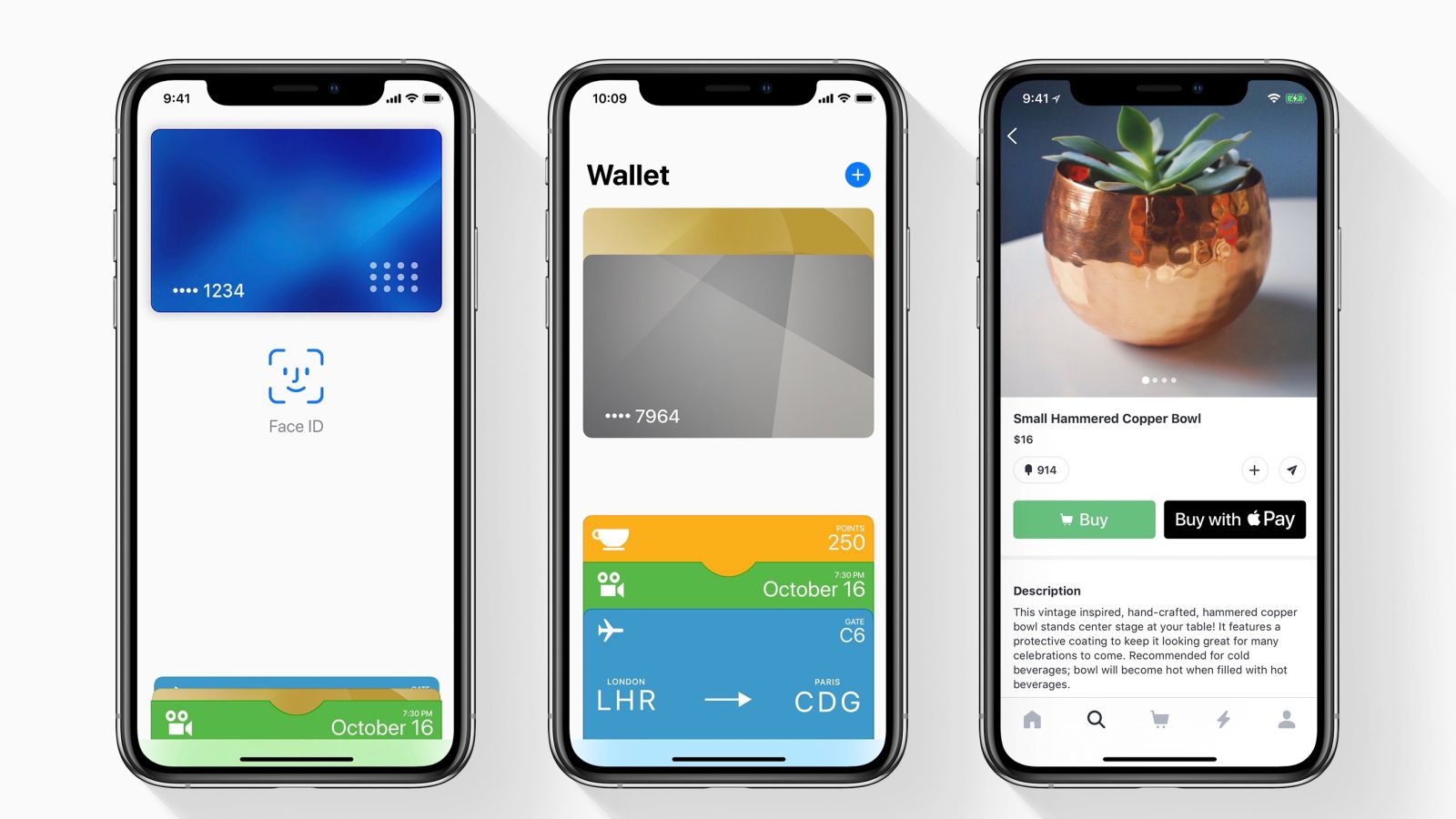

10. Apple Pay

Apple Pay was one of the first mobile payment operators to be launched here in 2016, even before its competitors Samsung Pay and Google Pay did.

Apple Pay works with your Apple devices and allows you to add your credit and debit cards to the Wallet to pay for purchases.

You can also link up your Singtel Dash Visa virtual card and pay merchants via Apple Pay.

Countries Available: United Kingdom, Canada, Australia, Brazil, Mexico, the United Arab Emirates, Saudi Arabia, Russia, Ukraine, Kazakhstan, China, New Zealand, Singapore, Japan, Macau, Georgia, Belarus, Montenegro, Serbia and all countries in the European Economic Area (EEA).

11. Huawei Pay

Huawei Pay was just launched here in April 2020.

It allows you to make payments with your Huawei or Honor devices by adding your bank cards.

Countries Available: Russia, Hong Kong (China), Macao (China), Pakistan, Singapore, Thailand, Malaysia, Germany, Austria, and South Africa.

12. Samsung Pay

Samsung Pay is a mobile payment service that enables the use of both credit and debit cards to make purchases. It was launched in Singapore on 16 June 2016.

You can add your loyalty cards to Samsung Pay as well.

Every transaction you make using the app earns you up to 30 Samsung rewards points, which you can use to redeem rewards and win prizes.

Countries Available: France, Italy, Spain, Sweden, Switzerland, Russia, United Kingdom, Brazil, Canada, Mexico, Puerto Rico, USA, Australia, China, Hong Kong, India, Malaysia, Singapore, South Korea, Taiwan, Thailand, and Vietnam.

Customer Lifetime Value

While the customer lifetime value (CLV) metric might not sound very important, failing to calculate it can put you behind your competitors.

CLV tells you how well you’re resonating with your audience, how much your customers like your products or services, and what you’re doing right — as well as how you can improve.

It’s a very crucial information for both business owners and marketers.

What is it?

Customer lifetime value (or life-time value (LTV), is the average amount of money your customers will spend on your business over the entire life of your relationship.

For instance, if a customer continues to buy products or services from your business for 10 years and spends $10 per year, his or her customer lifetime value is $100, minus any money you spent to acquire that customer.

Why is it important?

Your customers aren’t just worth the amount of money they spend on your business today. They have future value if you’re able to retain them as customers.

Let’s take advertising into account. It cost us $5 to attract one customer who wound up spending more than $700 in our fictional e-commerce store.

But what if we sold those 70 pairs of socks to 70 different customers?

We’d have to spend $5 per customer to acquire them, which would reduce our profits considerably. Plus, our brand loyalty would take a huge hit.

Customer lifetime value is important because, the higher the number, the greater the profits. You’ll always have to spend money to acquire new customers and to retain existing ones, but the former costs five times as much.

So instead of spending so much time and money sourcing out for new buyers and consumers, business owners and marketers should realize the value of CLV and how much more they can generate by improving customer experience and retaining them for the years to come.

How does In-App Wallets Affect CLV?

For one, digital wallets provide the convenience that cash payment doesn’t.

With mobile wallets, you don’t have to handle physical cash, which is especially great during the COVID-19 pandemic.

E-wallets are also fast, secure and accepted widely by various merchants.

In fact, since we are able to use mobile wallets widely in Singapore, we may feel inconvenienced if a certain merchant doesn’t accept any form of e-payment.

Another benefit is that some e-wallets are tagged to reward programs for you to stretch that dollar.

With all the perks e-wallets has in store for its users it’s no surprise that having one for your app can lead to retaining and prolonging your CLV.

Conclusion

It all boils down to great user experience. In this case considering everything happening today with the pandemic and the continuous digitization, in-app wallets certainly is a move forward towards quality user experience considering it’s efficiency and convenience this offers to users.

Also read, LOYALTY PAYS. CUSTOMER LOYALTY: WHAT IT IS AND WHAT REALLY MATTERS

Source:

https://www.crazyegg.com/blog/customer-lifetime-value/

https://blog.seedly.sg/e-wallet-digital-mobile-wallet-cashless-payment-singapore-guide/

Subscribe to my YouTube channel: Casey Ordoña